Frequently Asked Questions

When will the transition to APC Bank take place?

The transition will be completed by July 1, 2025. Until June 30, you will continue banking with PSB Bank as usual.

Do I need to do anything?

No. Your account will migrate automatically—no action required on your part.

Will my interest rates and terms change?

No. All existing features, interest rates and agreements remain unchanged.

Will my account number change?

Your account number stays the same for now.

What happens to my savings and time deposits?

Your savings rates and time-deposit terms remain identical and continue seamlessly at APC Bank. Any accrued but unpaid interest will transfer as well.

I have a savings passbook. What should I do?

Your passbook will no longer be used at APC Bank. You retain the same terms and can request online banking, mobile banking, or request a debit card at APC Bank. PSB Bank will provide you with a final statement showing your most recent transactions up to June 30, 2025, so you can stay fully informed.

What about my outstanding loan?

APC Bank will continue your loan with the same interest rate and repayment schedule. Your monthly payment won’t change.

Do my current insurance policies stay valid?

Yes. All existing policies remain fully in force.

Can I open a new account or request a loan at PSB Bank before the switch?

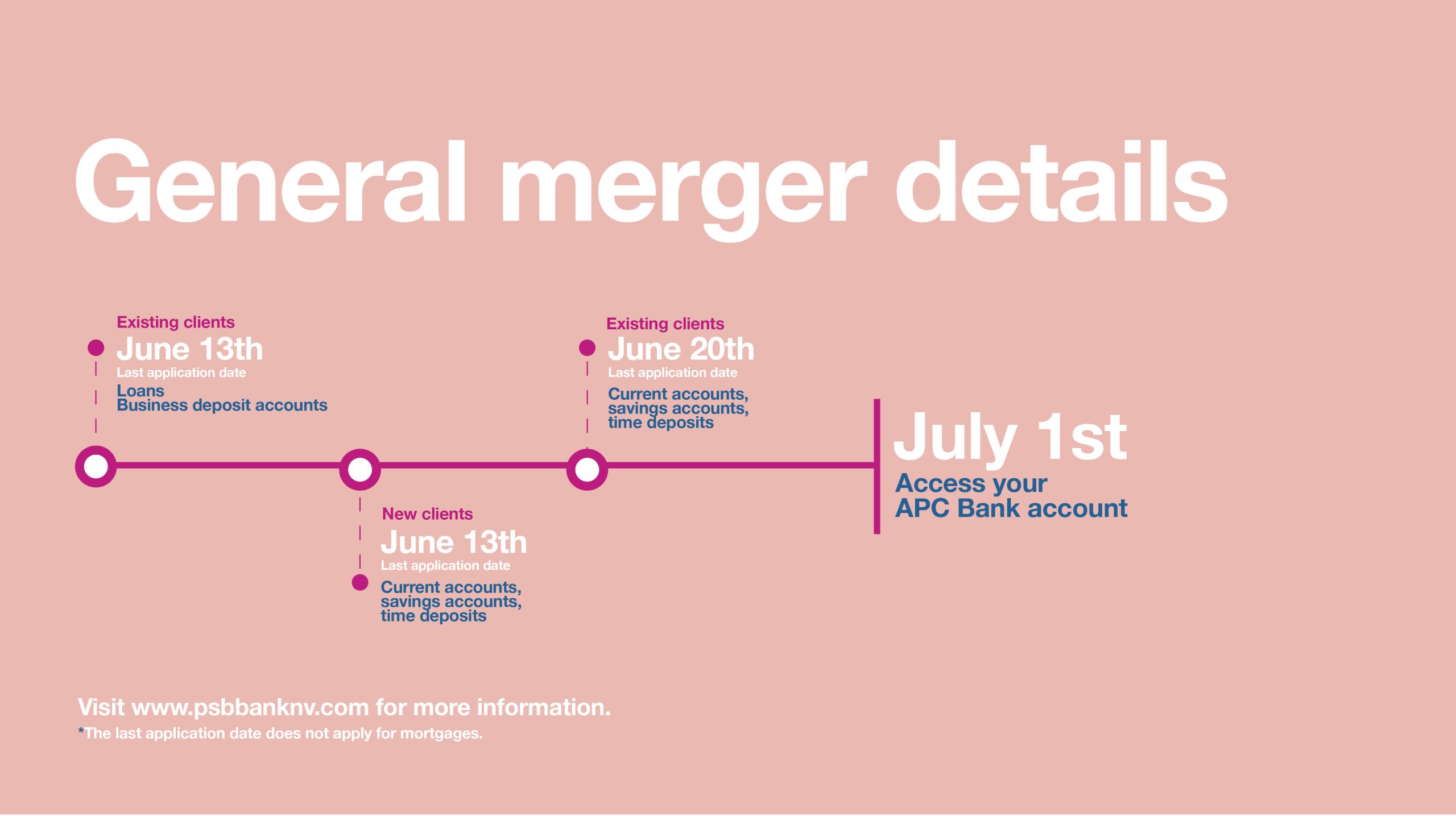

Yes, clients can apply for a new product by making an appointment and subject to these last application dates:

If you do not have an account at PSB Bank, you can also apply for new products subject to these last application dates:

- Current accounts, savings accounts and time deposit accounts: until Friday June 20, 2025

- Loans: until Friday June 13, 2025

- Mortgages: until Monday June 30, 2025

If you do not have an account at PSB Bank, you can also apply for new products subject to these last application dates:

- Current accounts, savings accounts and time deposit accounts: until Friday June 13, 2025

- Loans: until Friday May 30, 2025

- Mortgages: until Monday June 30, 2025

Can I open an account or apply for a loan after the last application dates?

No. After the last application dates, no new accounts will be opened at PSB Bank. However, we will ensure your contact information is passed on to APC Bank so that APC Bank can reach out to you directly once they are open.

Will my direct debits and standing orders transfer?

Yes. All existing automatic payments stay active and will remain unchanged.

Where can I find updates?

You can find the latest news on our website and Facebook and Instagram channels. We will also communicate via traditional media (radio and newspaper). In addition, please make sure we have your email address on file so we can send you updates directly—if we already have it, just keep an eye on your inbox.

I don’t have an email address or social media. How can I stay informed?Sample tab

Please contact our Customer Support team at +599 9 432 2000 (Curaçao) or +1 721 542 8004 (St. Maarten), and we’ll be happy to provide you with further instructions.

How can I get additional information?

By contacting Customer Support:

- Curaçao: +599 9 432 2000 or info@psbbanknv.com

- St. Maarten: +1 721 542 8004 or infosxm@psbbanknv.com

Need Help or More Info?

Call us at +599 9 432 2000 (Curaçao) or +1 721 542 8004 (St. Maarten)

Email info@psbbanknv.com (Curaçao) or infosxm@psbbanknv.com (St. Maarten)

Follow us on Facebook and Instagram for the latest announcements.

PSB Bank thanks you for 120 years of trust and invites you to continue writing history at APC Bank.